Paying for school can be expensive. Many people need to take out loans to cover the cost, but dealing with the debt and repayment options can be confusing. Some companies promise to help reduce student loan debt for a fee. But there’s nothing they’re able to do for you that you’re not able to do for yourself for free. And it’s illegal for companies to charge you before they help you. Some companies that promise student loan debt relief are scams. Here’s what to know about how student loans work — and how to avoid scams.

Paying for School

There are several types of financial aid that can help you pay for your education beyond high school. Those include grants and scholarships, federal work-study jobs, and student loans. If you’re trying to decide whether a financial aid offer will cover enough of the costs to make attending school affordable, the CFPB’s financial aid offer tool can help.

Grants and Scholarships

Grants and scholarships are free money that you don’t have to pay back. If you qualify for these, they’re the best choice for financing your education. Many grants and scholarships require that you complete the Free Application for Federal Student Aid (FAFSA®) form. Also, check out these other sources of grant and scholarship opportunities:

- the financial aid office at a college or career school

- a high school or TRIO counselor

- the U.S. Department of Labor’s free scholarship search tool

- federal agencies

- your state’s educational agencies

- searches online and at your library

- foundations, religious or community organizations, local businesses, or civic groups

- organizations related to your field of interest, like professional associations

- ethnicity- and heritage-based organizations

- your or your family’s employer

Federal Work-Study Program

Federal work-study jobs are another way to help pay for college. Work-study is a need-based grant that requires you to work part time while you’re in school. To qualify for work-study, fill out the FAFSA® form to see if you meet the needs-based criteria of the program. You’ll get paid only for the hours you work — and the amount you earn can’t exceed your total Work-Study award. Talk to your school’s financial aid office for more information.

Federal and Private Student Loans

Federal student loans are issued directly by the U.S. Department of Education and have important benefits and protections for borrowers (such as fixed interest rates and flexible payment plans). These types of loans include

- Direct Loans, which can be need-based and subsidized (the government pays the interest while you’re in school) or not need-based and unsubsidized (the interest accrues while you’re in school)

- Direct PLUS Loans, which graduate or professional students, and parents of dependent undergraduate students, can use to help pay for college or career school. PLUS loans can help pay for educational expenses not covered by other financial aid.

- Two types of federal loans that are no longer available, but people might still be repaying:

- Federal Family Education Loans (FFEL), which were loans made by private lenders and backed by the federal government, and

- Federal Perkins Loans, which were low-interest federal student loans that were for undergraduate and graduate students with exceptional financial need.

Private loans, sometimes called “alternative loans,” are offered by private lenders, like banks and credit unions. They are not backed by the federal government and do not include the benefits and protections that come with federal student loans. They may also require a co-signer (someone else who will also be required to pay back the loan) and a credit check (a review of your credit history).

For more information on the differences between federal and private student loans, check out this comparison chart from the U.S. Department of Education.

Applying for Financial Aid

The only way to apply for federal student aid is by filling out the FAFSA® form. It’s free to apply. Fill out your FAFSA® form at fafsa.gov the year before you start college, university, or career school and at the start of every year you’re in school.

Many states and colleges use your FAFSA® data to decide whether you’re eligible for aid from your state and your school. Some private financial aid providers may use your FAFSA® information to figure out whether you qualify for their aid, too.

Filling out the FAFSA® form

When you fill out your FAFSA® form, you’ll also create your Federal Student Aid Identification, known as your FSA ID. The FSA ID is a username and password that lets you

- get into your Federal Student Aid account to view your loan, grant, and enrollment history

- fill out your FAFSA® form

- learn about and compare repayment plans tailored to your situation

- complete your Master Promissory Note, which is a legal document where you promise to repay your loan(s) and any accrued interest to the U.S. Department of Education

- apply for income-driven repayment plans or loan consolidation, and complete other loan-related documents

Only you are able to create and use your FSA ID. Don’t share your FSA ID with anyone, no matter who asks or what they say. Dishonest people could use your FSA ID to get into your account and steal your personal information.

Repaying Your Loans

Student loans are debts you have to pay back, even if you don’t finish your degree. But depending on your situation and the kind of loans you have, you might be eligible for a different repayment plan or loan forgiveness.

Some companies might contact you, saying they can get you prequalified for a special government payment reduction or forgiveness program. But when it comes to qualifying for repayment and forgiveness programs, there’s nothing a private company can do for you that you can’t do yourself for free. It’s totally free to sign up for repayment and forgiveness programs by either calling your loan servicer (that’s the company that manages the billing for your student loan) or going to StudentAid.gov.

If you do decide to use a company that’s promised to lower your repayment, remember it’s illegal for them to charge you before they help you.

Repaying federal student loans and avoiding default

The Department of Education has free programs that could help you repay your federal loans, including

- income-driven repayment plans that base your monthly payment on how much money you earn.

- deferment and forbearance programs that let you postpone your payments, depending on the reason you can’t repay. In many cases, the interest might continue to accrue and increase the amount you’ll owe.

- loan forgiveness or loan discharge programs that forgive or discharge some or all of your loans. You might qualify if, for instance, you work for a government or non-profit organization, if you become disabled, or if your school closed or committed fraud. Also, under certain income-driven repayment plans, any balance still owed after 20 or 25 years of payments is forgiven.

These options are free. Learn more at the Department of Education’s site StudentAid.gov/repay or by contacting your federal student loan servicer.

Federal loans give borrowers various options to avoid default. If you fall behind on your federal student loan payments, there are steps to avoid default, limit the amount of late fees you need to pay, and get back on track.

Repaying private student loans and avoiding default

Private student loans typically offer fewer options for repayment, loan forgiveness, or cancellation. To explore your options, contact your lender directly. If you don’t know who your lender is, look at a recent billing statement.

Private loans generally offer borrowers fewer protections against default than federal loans. But if you do get behind with your payments, contact your lender to see what your repayment options may be. It may also be helpful to review your private loan contracts carefully to better understand your rights if you do go into default on your loans.

Income Share Agreements

If you’re looking for an alternative to student loans, you might hear about income share agreements (ISAs). When you enter an ISA, your school agrees to cover your tuition — and sometimes your living expenses — during college. In exchange, you agree to pay the school a percentage of your income for a set number of years after you graduate or leave the school. But an ISA may end up costing you much more than a student loan and won’t have the same protections as federal student loans.

To decide if an ISA is right for you, consider these questions:

What are the terms of the ISA?

Before you agree to an ISA, clarify the percentage of future income you’ll be expected to pay, and how long you’ll be required to make your payments. Keep in mind that because your payments will be a percentage of your income, the more you earn after leaving school, the more expensive the ISA will be. ISAs are usually offered by the semester or school year, so review these terms every time you take on an ISA. For example, during your first year of school, your rate could be five percent of your future income; the next year, it could increase to ten percent. If the terms become too expensive, consider looking into other financial aid options. Remember: whether or not you graduate, you’ll have to repay your ISA.

What might your expected income be?

The repayment terms for ISAs will vary depending on your major, the likelihood you land a job in the field you want, and your expected income. Do some research on how easy (or hard) it is to land a job in your preferred field, what past graduates from your college have earned in that field, and how much someone with your planned career could expect to earn. Use the expected income to estimate what your ISA might end up costing you overall. Make sure that you will be able to afford your other living expenses along with your ISA monthly payments even if you don’t land the job you want.

What happens if the payments are unaffordable?

Unlike federal student loans, ISAs don’t have deferment or forbearance options if you’re unable to make your payments. Even if the ISA allows you to make reduced payments based on your income, the payments still may be difficult to comfortably afford. Some ISAs may not require payment if your income is below a certain amount, but others may make you keep paying no matter what your income is.

How do the costs of an ISA compare to the costs of student loans?

In general, federal student loans will be the lowest cost option, but it’s important to compare all your options to know what works best for you. The two costs to focus on are your monthly payments and your overall costs.

Both federal and private loans charge interest on the amount you borrow, which is the cost of borrowing money. Federal loans always have fixed interest rates, which means the amount you pay back generally won’t change (with some exceptions, like if you sign up for an income-driven repayment plan). In contrast, private loans may have variable interest, which means the amount you owe could change over time.

Unlike a student loan with a fixed interest rate, your estimated ISA costs can vary significantly based on how much you earn in the future, which makes estimating costs difficult. Here are some scenarios to consider:

- How much would you pay if you were unemployed or underemployed?

- How much you would pay if you were making the average salary of someone in your field?

- How much you would pay if you were making a high income?

Each ISA and student loan you take out or agree to can have different terms. That means that semester to semester, or year to year, you’ll want to re-check these numbers before agreeing to a new ISA.

Loan Consolidation

When you consolidate your student loans, you’re combining multiple loans into one loan. You might consolidate your loans to simplify monthly payments or to extend the repayment term to lower your monthly payment. When you consolidate your loans, you get a brand-new loan with new terms.

Before you consolidate your loans, take your time. Find out what consolidating could mean for your specific situation. If you have private loans, talk to your lender. For federal loans, call the Department of Education’s Loan Consolidation Information Center at 1-800-557-7394.

Consolidating your federal student loans into a Direct Consolidation Loan

Consolidating federal loans directly with the federal government is always free. Some companies may offer to help consolidate your federal loans for a fee, but you don’t have to pay for this service. To consolidate your federal student loans with the federal government on your own, contact your student loan servicer directly.

When you consolidate your federal student loans, you’ll get a Direct Consolidation Loan with a fixed interest rate for the life of the loan.

But it might not make sense to consolidate certain loans if, for example, they have unique deferment or cancellation rights that might be lost upon consolidation. Once your federal student loans are combined into a Direct Consolidation Loan, they can’t be separated again. So, consider the type of federal student loans you have and whether the reasons to consolidate outweigh the reasons not to consolidate.

Reasons to consolidate federal loans into a Direct Consolidation Loan

- Your repayment will be simpler. You’ll have a single loan with one servicer and just one monthly bill.

- You’ll have more time to repay your loans. Consolidation can give you up to 30 years to repay your loan, which can mean a lower monthly payment. (But you’ll end up paying more in total.)

- You’ll gain access to different repayment plan options. You might gain access to additional income-driven repayment plan options and Public Service Loan Forgiveness. (But not all federal loans will qualify. For example, the FFEL program is not eligible for this benefit.)

- You can switch variable-rate loans to a fixed interest rate. This can give you more certainty about your monthly budget.

Reasons not to consolidate federal loans into a Direct Consolidation Loan

- You’ll pay more in the end. A longer time to repay your loans means more (but lower) monthly payments. That also means paying more in interest than you would without consolidating.

- You might lose existing borrower benefits. Certain types of federal loans come with borrower benefits — like interest rate discounts, principal rebates, or some loan cancellation benefits — that you might lose if you consolidate.

Not sure about loan consolidation but having trouble making your monthly payments? Consider contacting your loan servicer about deferment or forbearance as options for short-term payment relief, or consider switching to an income-driven repayment plan.

Consolidating your private loans

The federal government does not consolidate private student loans. Private lenders do. The lender might charge a fee to consolidate your loans, but avoid companies that tell you to pay up front.

Consolidating private and federal loans turns all your loans into a private loan. That means you’ll lose federal repayment benefits and protections, like deferment and forbearance, and will no longer have access to income-driven repayment plans and potential loan forgiveness programs.

Make sure you understand all the conditions of your consolidated loan before you agree to consolidate — especially if you have both private and federal student loans. Some debt relief companies and lenders offer to consolidate private and federal loans together. They offer one new loan to lower your monthly payments or interest rate. Don’t do it.

How To Avoid a Student Loan Debt Relief Scam

You’ve probably seen ads from companies promising to help with your student loan debt. But know that there’s nothing a student loan debt relief company can do for you that you aren’t able to do for yourself for free. And some of the companies that promise relief are scams.

Here are some ways to avoid a student loan debt relief scam:

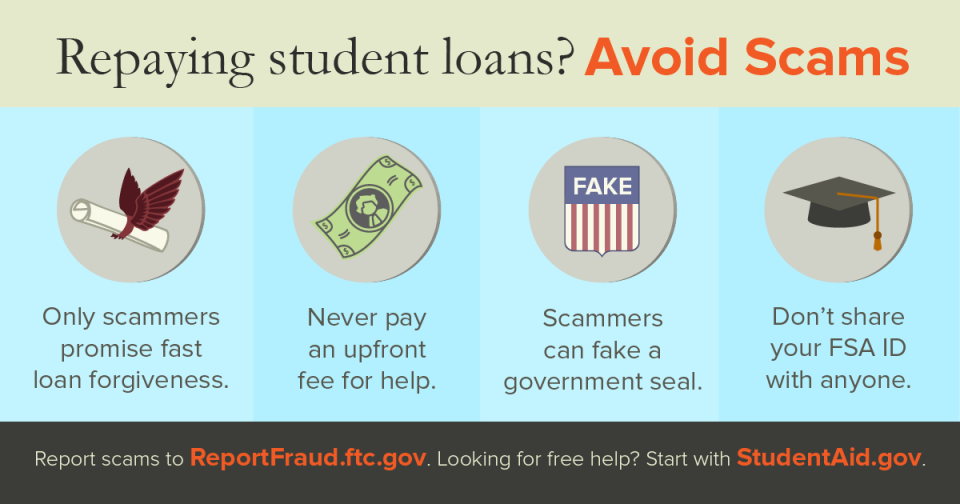

- Never pay an upfront fee. It’s illegal for companies to charge you before they help you. If you pay up front to reduce or get rid of your student loan debt, you might not get any help — or your money back.

- Don’t sign up for quick loan forgiveness. Before they know the details of your situation, scammers might say they can get rid of your loans. They might promise a loan forgiveness program that most people won’t qualify for. Or they might say they’ll wipe out your loans by disputing them. But they can’t get you into a forgiveness program you don’t qualify for or wipe out your loans.

- Don’t trust a Department of Education seal. Scammers use official-looking names, seals, and logos. They promise special access to repayment plans, new federal loan consolidations, or loan forgiveness programs. It’s a lie. If you have federal loans, go to the Department of Education directly at StudentAid.gov.

- Don’t be rushed. To get you to act fast, scammers say you could miss qualifying for repayment plans, loan consolidation, or loan forgiveness programs if you don’t sign up right away. Take your time and check it out.

- Don’t give away your FSA ID. Some scammers claim they need your FSA ID to help you, but don’t share your FSA ID with anyone. Dishonest people could use that information to get into your account and steal your identity.

Where To Get Help

You don’t have to pay for help with your student loans. There’s nothing a company can do for you that you aren’t able to do yourself for free. If you have federal loans, start with StudentAid.gov/repay. If you have private loans, contact your lender directly.

What To Do if You Paid a Scammer

Scammers often ask you to pay in ways that make it tough to get your money back. No matter how you paid a scammer, the sooner you act, the better. Learn more about how to get your money back.

Report Scams

Report student loan scams to

- the FTC at ReportFraud.ftc.gov

- your state attorney general