Spot and Avoid Fake Charities

Many legitimate charities support local firefighters and police, active duty military, and veterans, or their families. But other charities lie about what they do with donations or how much they spend on programs. And some are outright scams. Here are some things you can do to avoid donating to a fake charity:

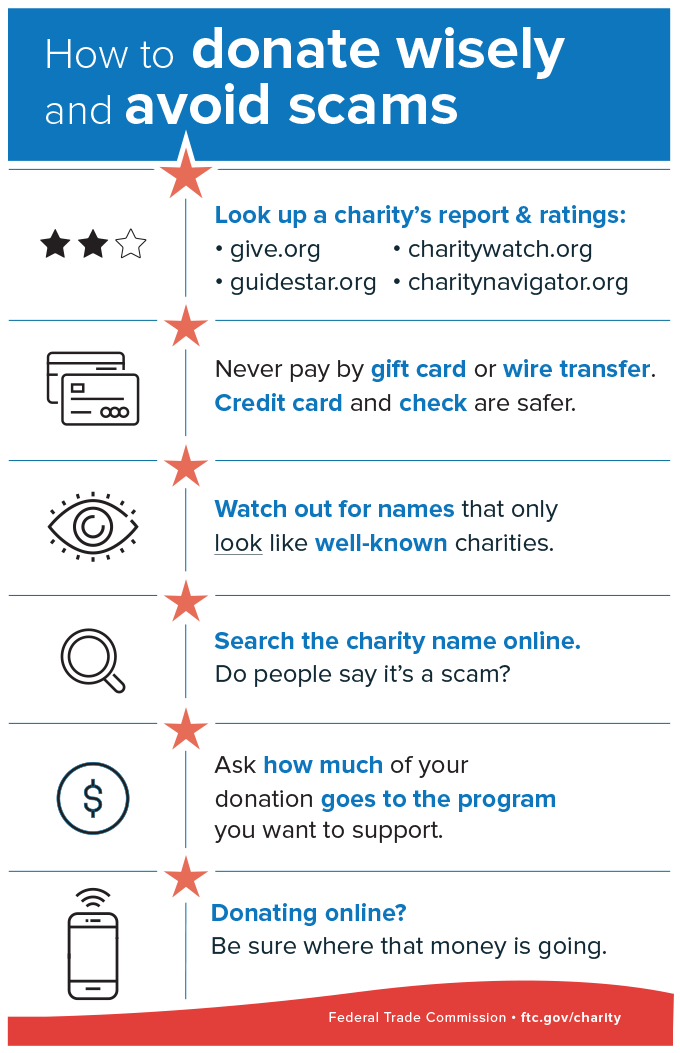

- Pay attention to the charity’s name. Scammers use names that sound like well-known charities, or that include words like “veteran,” “foundation,” “operation,” “hero,” “wounded,” “disabled,” or “homeless.” This infographic has examples of sham charities that used names that sounded legitimate, but lied to donors.

- Pay attention to how the charity or fundraiser asks you to pay. Scammers ask you to donate through wire transfers, by putting money onto gift cards and sending them the codes on the back, or leaving money under your front doormat for pick up. Don’t do it. Only scammers will ask you to donate that way.

- It’s safest to donate by credit card or check — after you’ve done some research on the charity.

- If you’re donating online, make sure the webpage where you enter your payment information has “https” in the web address. That means your information is encrypted and transmitted securely. But encryption alone doesn’t mean the site is legit. Scammers know how to encrypt, too.

- Don’t trust your caller ID. Scammers can make any name or number show up on your caller ID. They make their calls look like they’re from your local area code, a Washington, D.C. area code, or from an organization you know. But that call could be coming from anywhere.

- Don’t trust someone who rushes you into donating. Scammers pressure you to donate immediately. They rush you so there’s no time to do any research or even think about what you’re agreeing to do. A legitimate charity will welcome your donation at any time.

Phone Calls Asking You To Donate

Many charities that help first responders — like police officers and firefighters — veterans, and active duty military, or their families, pay fundraisers to call donors or potential donors.

Fundraising calls are allowed even if your number is on the National Do Not Call Registry. If you want fundraisers to stop calling, ask them to put you on the charity’s do not call list. When a charity’s fundraiser calls to ask you for a donation, they have to follow some rules:

- They can only call during specific times. They can't call you before 8 a.m. or after 9 p.m.

- They have to disclose their name and purpose. They have to tell you the name of the charity, and tell you if the reason they’re calling is to seek a donation.

- They can’t deceive you or lie about:

- The fundraiser’s connection to the charity.

- The mission or purpose of the charity.

- Whether a donation is tax deductible.

- How a donation will be used, or how much of the donation actually goes to the charity’s programs.

- The charity’s affiliation with the government.

- They can’t use a robocall or prerecorded message to reach you unless you are a member of the charity or a prior donor, and even then they must offer you a way to opt out of future calls.

- Their caller ID has to be truthful. The caller ID on your phone has to show the name of the charity or fundraiser, along with a number that you can call to ask to be placed on the charity’s do not call list.

4 Questions To Ask a Fundraiser

Here are four questions to ask someone who says they’re raising funds for a charity that helps first responders, active duty military, veterans, or their families.

- What is the charity’s exact name, web address, and mailing address? Some dishonest telemarketers use names that sound like large well-known charities to confuse you. You’ll want to confirm this information later.

- How much of my donation will go directly to the program I want to help? The caller is most likely a fundraiser, not the charity itself. So after the fundraiser gives you its answer, call the organization directly and ask them, too. Or see if the information is on the charity’s website. What else does the charity spend money on? Some fundraising can be very expensive, leaving the charity with little money to spend on its programs.

- Are you raising money for a charity or a Political Action Committee (PAC)? Not every call seeking a donation is from a charity. Some calls might be from a PAC where donations are not deductible and the PAC will use the money in a different manner than a charity would.

- Is the charity registered and will my donation be tax-deductible? To be sure, though, look up the charity in the IRS’s Tax Exempt Organization Search. If a donation to the charity is really tax deductible, the organization will be listed there. Remember that donations to individuals and PACs are not tax deductible. Also check to see if the fundraiser and charity are registered with your state’s charity regulator.

After you’ve gotten your answers, hang up the phone and do your own research.

Mail Asking You To Donate

Organizations that help veterans and military families often use direct mail to create awareness and fundraise. The good thing about getting a charitable solicitation in the mail is that it gives you time to research the organization.

Here are a few things to do or consider when you get a donation request in the mail:

- Look for details about what happens with your donation. Check if the letter has details about the organization’s programs, past successes, and plans to use funds in the future. If the letter doesn’t specify that, be suspicious.

- Know that if you respond, you’ll get more mail. Charities often share donor lists. If you want to stop getting solicitations or get fewer, write to individual charities and ask them to delete your name from their mailing lists. It may take some work to get them to do this. You can do this even if you donate.

Social Media and Crowdfunding Posts Asking You To Donate

Especially after a tragedy or military-related event, fundraisers and causes show up on social media and people create crowdfunding campaigns to help those affected. The safest way to donate on social media or crowdfunding campaign is to give to people you actually know. Here are a few ideas to help you give safely:

- Don’t assume the request is legitimate because a friend posted it. Pay attention to who first posted the request on social media. Contact your friend privately or offline to ask them about the post they shared.

- Check where the link to donate goes. Does it go to a crowdfunding campaign for an individual or to a charity? If the money is going to an individual campaign organizer, are you sure that person will pass the money on to the cause you want to support? Confirm with whoever posted the link that they know the person behind the fundraising. If the money goes to a charity, do your research on the charity. Just because a friend recommended it doesn’t guarantee that the charity will spend your money wisely.

- Keep in mind that your donation must be to a charity to be tax deductible. If it’s important to you that the donation is tax deductible, confirm that the organization is registered with the IRS as a charity. Look up the organization in the IRS’s Tax Exempt Organization Search tool. Donations to individuals and PACs are not tax deductible.

Read Donating through Crowdfunding, Social Media, and Fundraising Platforms for more tips on what to look for when you’re asked to donate on social media or to a crowdfunding campaign.

How To Research Charities

Before you donate, it’s a good idea to do some research. Here are three important things to do before you give money to someone who says they’re raising funds for a charity that helps first responders, active duty military, veterans, or their families.

- Search online. Search the charity’s name online with words like “complaint” and “fraud” or “scam.” You can also search for the phone number displayed in your Caller ID. See what others have to say.

- Check out reports and ratings. You can do it through the BBB Wise Giving Alliance and CharityWatch. Find out what percentage of donations are used for charitable programs. These groups typically have lists of highly rated charities that help veterans or first responders that they have already vetted.

- See if the charity is registered with your state charity regulator. Most states require charities to register before soliciting. You can find your state regulator at nasconet.org.

- Is it a non-profit organization or a Political Action Committee (PAC)? If you’re donating to a charitable organization recognized by the IRS, your donation is tax deductible. Use the IRS’s Tax Exempt Organization Search to check. Donations to a PAC are not tax-deductible and the PAC will use the money in a different manner than a charity.

- Call your local police or fire department. If a fundraiser claims that they’re collecting donations on behalf of your local police or fire department, verify that directly with them. If the claim can’t be verified, report the solicitation to your local law enforcement officials.

Read Before Giving to a Charity for more.

Report Charity Scams

Report charity scams to

- the Federal Trade Commission at ReportFraud.ftc.gov

- your state charity regulator, which you can find contact information for at nasconet.org

Give as much information as you can in your report, including the name of the fundraiser who contacted you, the name, phone number, website, and address of the charity, and any other details the fundraiser gave about the charity.