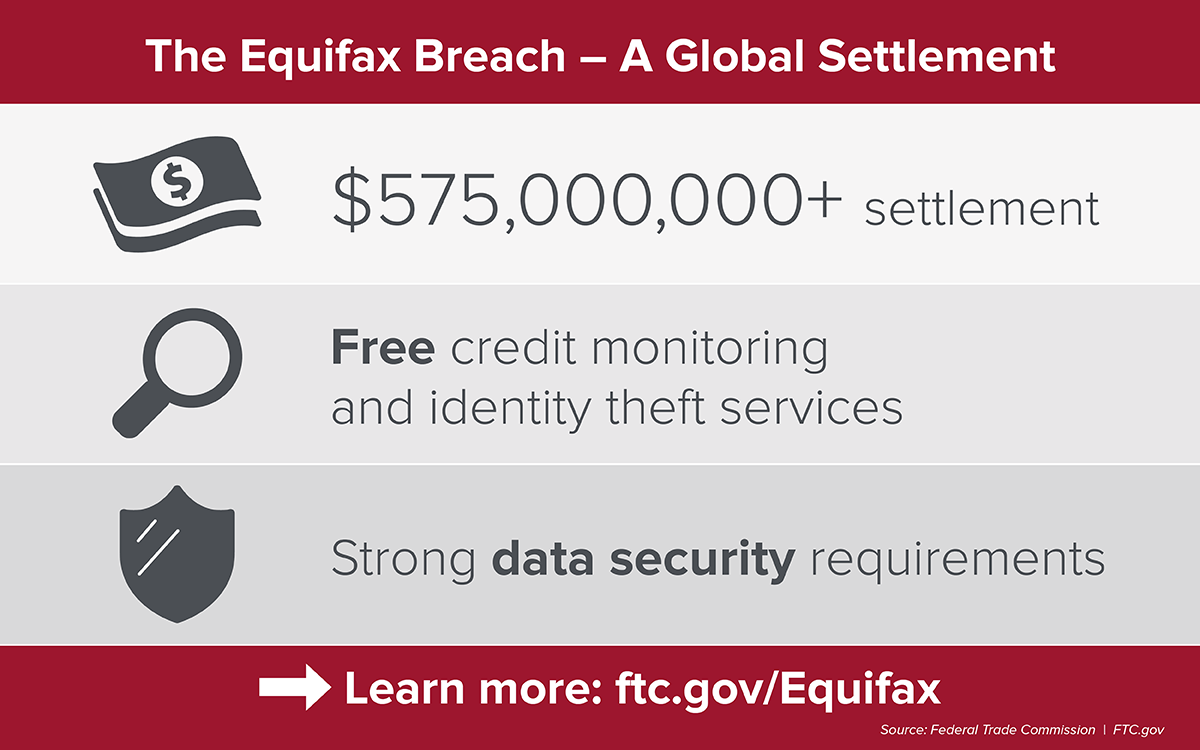

In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. Under a settlement filed today, Equifax agreed to spend up to $425 million to help people affected by the data breach. If you were affected by the Equifax breach, you can't file a claim just yet. That's coming. But you can sign up for FTC email alerts about the settlement at ftc.gov/Equifax.

(Not sure that you were affected? The breach claims site will have a tool to let you check. Sign up for an FTC email update to find out when that tool is up and running.)

Here’s what you need to know about the settlement.

Benefits Available To You

If you were affected by the breach, you may be eligible for benefits.

1. Free Credit Monitoring or Cash Payment

You can get at least 4 years of free credit monitoring of your credit report at all three credit bureaus (Equifax, Experian, and TransUnion). On top of that, you can get up to 6 more years of free credit monitoring of your Equifax credit report. That’s a total of 10 years of free credit monitoring. (Minors affected by the breach are eligible for even more free credit monitoring.)

If you have credit monitoring that will continue for at least 6 months and you decide not to enroll in the free credit monitoring offered in the settlement, you may be eligible for a cash payment. The amount you’d get will depend on the number of claims filed.

2. Reimbursement for Your Time and Other Cash Payments

You may be eligible for reimbursement and cash payments up to $20,000 for:

- time you spent protecting your identity or recovering from identity theft, up to 20 hours at $25 per hour

- money you spent protecting your identity or recovering from identity theft, like the cost of freezing or unfreezing your credit report or unauthorized charges to your accounts

- up to 25% of the cost of Equifax credit monitoring or identity protection products you bought between September 7, 2016 and September 7, 2017

3. Free Identity Restoration Services

You are eligible for free identity restoration services for at least 7 years that you can use if someone steals your identity or you experience fraud.

Next Steps

The claims process will start after court approval. To learn more about the settlement, go to ftc.gov/Equifax. We’ll update that page when there’s new information.

You can also sign up to get FTC email updates about this settlement.

If you were affected by the breach, you may also receive an email notification after the court approves the settlement. The notification will provide more information about the settlement, the benefits available to people impacted, and how to request the services offered under the settlement.

This blog post was updated on August 1, 2019.

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

In reply to Hi, I have been paying $30 to by MLL

I can't see a claim form because I'm not filing a claim.

But, the Quick Instructions on the settlement website (www.EquifaxBreachSettlement.com) say you can fill out one or more sections of the claim, depending on whether you want:

In reply to How do I exempt myself from by MrBaker

Equifax is one of three national credit bureaus. These companies collect information about your credit history, such as how many credit cards you have, how much money you owe, and how you pay your bills. Each company creates a credit report about you, and then sells this report to businesses who are deciding whether to give you credit. You cannot opt out of this data collection. However, you can review your credit report for free andfreeze your credit.

In reply to When the settlement was by Disatisfied wi…

The settlement website (www.EquifaxBreachSettlement.com) has information about how to exclude yourself from the settlement in the Frequently Asked Questions.

In reply to How do I access free credit by curious and pe…

If you filed a claim for free credit monitoring under the settlement, the company that manages the settlement will send you information about how to activate your credit monitoring after the Settlement is effective. The company will send you an activation code and link to the Experian website where you can enroll and activate your Credit Monitoring Services. The settlement will be effective on January 23, 2020 at the earliest. Read more at www.FTC.gov/Equifax.

In reply to If you filed a claim for free by FTC Staff

In reply to Our claim was submitted july by kate

If you filed a claim for free credit monitoring under the settlement, the company that manages the settlement will send you information about how to activate your credit monitoring after the Settlement is effective. The company will send you an activation code and link to the Experian website where you can enroll and activate your Credit Monitoring Services. The settlement will be effective on January 23, 2020 at the earliest. Read more at www.FTC.gov/Equifax.

Pagination