Every year, millions of you tell us – and our partners – about the frauds you spotted. Last year, we heard from 3 million of you, and here’s some of what we learned from your reports:

- We collected more than 1.4 million fraud reports, and people said they lost money to the fraud in 25% of those reports. People reported losing $1.48 billion (with a ‘b’) to fraud last year – an increase of 38% over 2017.

- The top reports in 2018 were: imposter scams, debt collection, and identity theft.

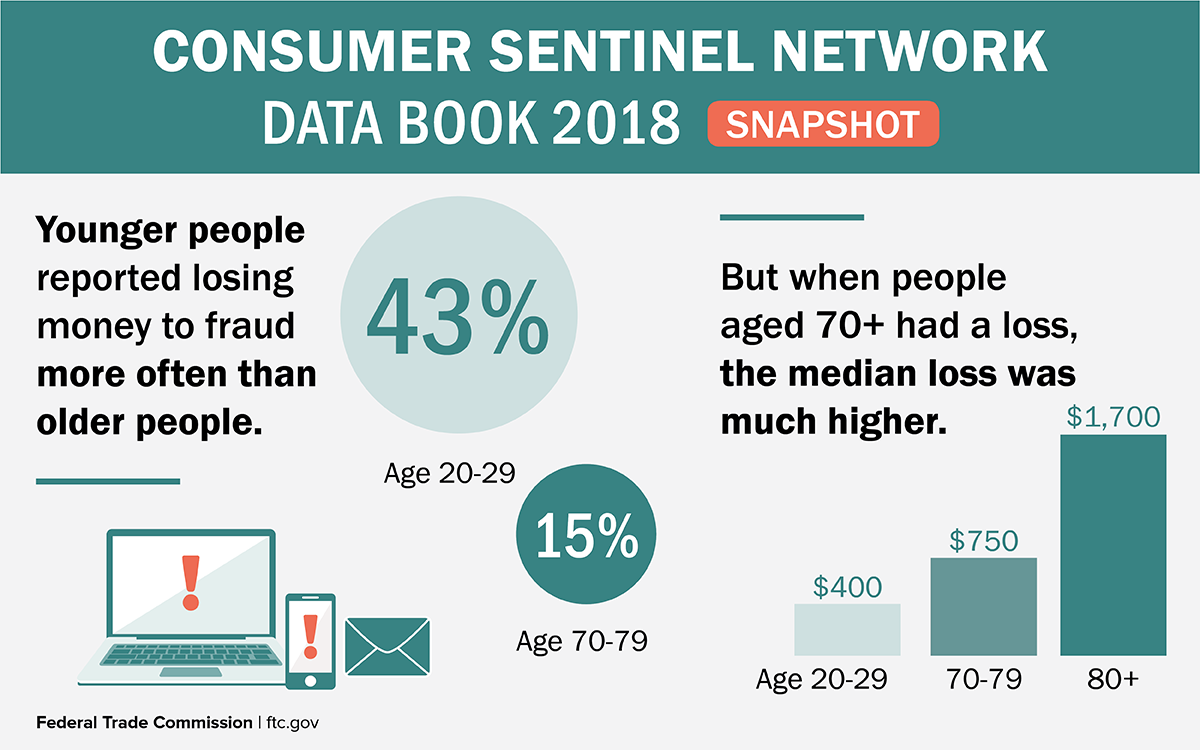

- Younger people reported losing money to fraud more often than older people. Let that sink in. It’s what the data have been telling us for a while, but it’s hard for people to grasp. Last year, of those people who reported fraud and their age, 43% of people in their 20s reported a loss to that fraud, while only 15% of people in their 70s did.

- When people in their 70s did lose money, the amount tended to be higher: their median loss was $751, compared to $400 for people in their 20s.

- Scammers like to get money by wire transfer – for a total of $423 million last year. That was the most of any payment method reported, but we also saw a surge of payments with gift and reload cards – a 95% increase in dollars paid to scammers last year.

- Tax-related identity theft was down last year (by 38%), but credit card fraud on new accounts was up 24%. In fact, misusing someone’s information to open a new credit card account was reported more often than other forms of identity theft in 2018.

- The top 3 states for fraud and other reports (per 100K population) are Florida, Georgia and Nevada. The top 3 states for identity theft reports (also per 100K) are Georgia, Nevada and California.

Check out what happened in your state. In fact, you can play around in the numbers yourself. And let us know in the comments if you find something interesting. Meanwhile, keep reporting to the FTC at ftc.gov/complaint. We use those reports to investigate and bring cases – and so do our thousands of law enforcement partners.

In reply to Isn't it possible that the by mschwmmr

In reply to Spot on. by M

In reply to I wonder if the reason why by aevans2911

In reply to I wonder if the reason why by aevans2911

In reply to I just rec'd a check from by Peacesister

In reply to I just rec'd a check from by Peacesister

In reply to I just rec'd a check from by Peacesister

In reply to I don't see a list of the by clansey

To read the full report, go to the beginning of this blog post and click on the words that are highlighted in blue. You will be connected the the full report and can read a list of the top frauds.

In reply to I am a 57 year old single by Debby D.