Most people go to college to earn a degree and get a good job. In a competitive job market, it helps to have connections. So when a college or university claims it has relationships with well-known employers, that may convince you to attend. But beware: Claims like this may be a ploy to attract new students — and your tuition dollars. In fact, the FTC says that’s just what one for-profit university did as part of an extensive advertising campaign.

In a proposed settlement announced today, the FTC says that for-profit University of Phoenix, and its parent company, Apollo Education Group, Inc., falsely claimed that their relationships with top companies created job opportunities specifically for Phoenix students and deceptively claimed they worked with these companies to develop courses.

The FTC says that University of Phoenix used a multi-media ad campaign to attract students, including ads specifically targeted to military and Hispanic consumers. The companies’ “Let’s Get to Work” campaign featured several high-profile employers, including Microsoft, Twitter, Adobe, and Yahoo!, giving the false impression that UOP worked with those companies to create job opportunities for its students.

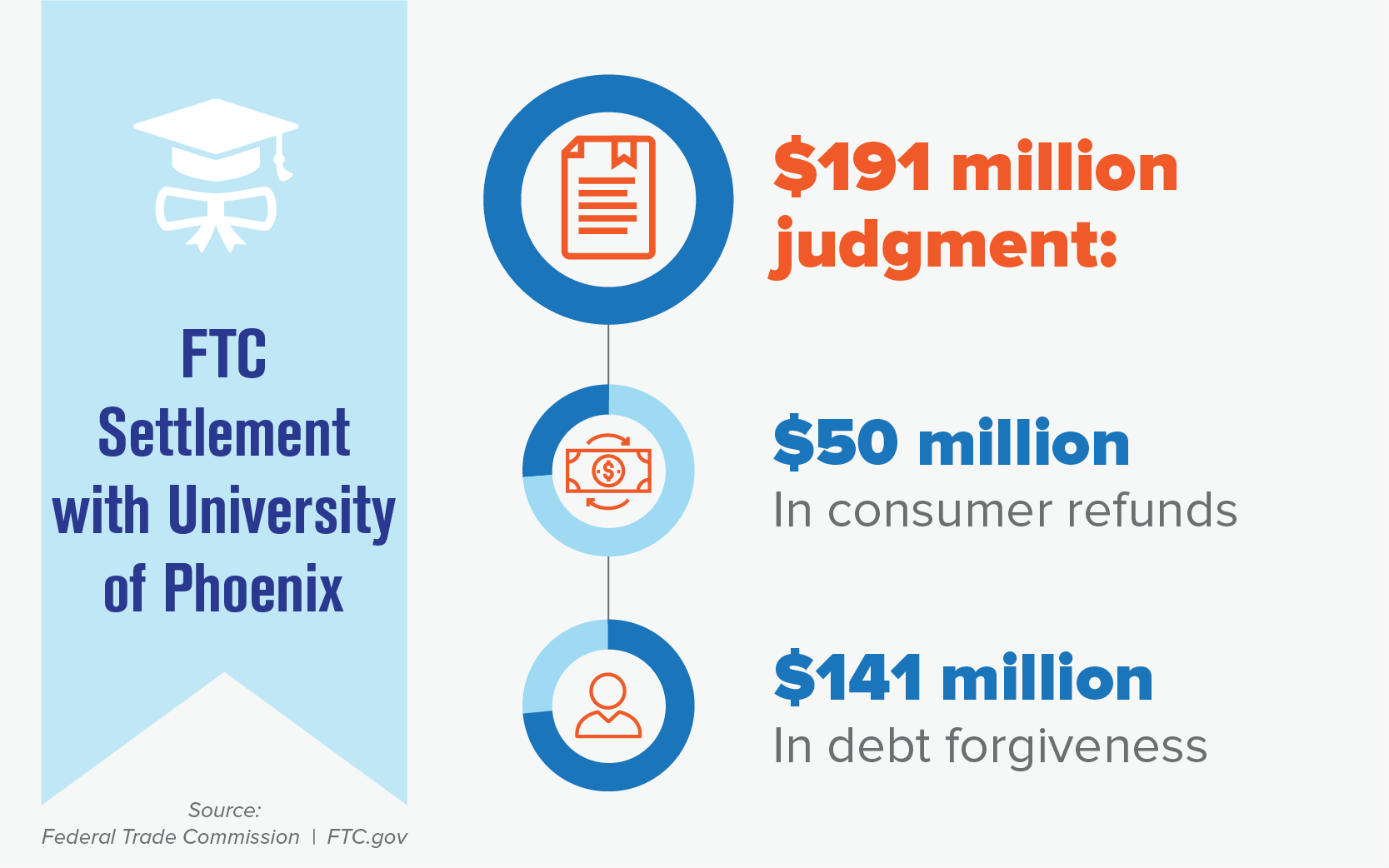

As part of the $191 million settlement, the companies will return $50 million in cash to former students and cancel $141 million in student debt owed directly to the school. The proposed order prohibits the companies from further deceptive business practices. In addition, it requires them to ask consumer reporting agencies to delete the debts from people’s credit reports, give notice to those who got debt cancellation, and make sure people have access to their diplomas and transcripts.

Before enrolling in school, it’s important to do your homework. You can get important information about any school at the U.S. Department of Education’s College Navigator. For example, if you enter a school’s name, you can find out if it’s public or private, for-profit or non-profit, its accreditation status, and its student loan default rates.

Also, check out what are people are saying about schools you’re considering. Search online for the school’s name plus words like “review,” “complaint” or “scam.”

If you’re looking to advance your education, do your homework to be sure you know what you’re paying for. Check out Choosing a College: Questions to Ask.

Added on December 19, 2019: The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

In reply to I am not sure if i Qualify by Mr. J

Under the settlement, the University of Phoenix will cancel $141 million in debts of people who first enrolled during the period starting October 1, 2012 and ending December 31, 2016, during the time people were probably exposed to the school's deceptive advertising. The University will cancel debts that people owe directly to the school. The debts will be forgiven whether they were charged as fees or some other kind of charge.

University of Phoenix will send a notice to each person whose debt to the school is being cancelled.

In reply to Under the settlement, the by FTC Staff

In reply to Why is it not before? by ACW77

In reply to Under the settlement, the by FTC Staff

In reply to I took out Federal loans, why by Kristen

In reply to I got my Bachelors Degree by nessaj

In reply to I got my Bachelors Degree by nessaj

In reply to I went from 2013 - 2016 and by Raiden8816

The settlement between the FTC and the University of Phoenix does not affect students' private loans or federal government loans.

Under the settlement, the University will cancel $141 million in debts that are owed directly to the school by people who first enrolled between October 1, 2012 and December 31, 2016.

The University will cancel debts owed directly to the school whether they were charged as fees or some other kind of charge. The University will send a notice to each person whose debt to the school is being cancelled.

In reply to so basically no one is by brandiawilliams

Under the settlement unanimously approved by the FTC the University will pay $50 million in cash to the FTC and cancel $141 million in debts owed to the school by students who were harmed by the deceptive ads. The settlement requires UOP to pay $50 million to the Commission, which will be used for consumer redress.

In reply to The complaint stated that the by Willyrayk

The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. That could include people who used military benefits. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to The FTC will identify people by FTC Staff

In reply to I went to University of by Defraided

Under the settlement between the FTC and the University of Phoenix, the University will cancel $141 million in debts that are owed directly to the school by people who first enrolled at the school between October 1, 2012 and December 31, 2016. The University will send a notice to each person whose debt to the school is being cancelled.

The University also paid $50 million to the FTC as part of the settlement. The FTC will identify people who are eligible for a payment from the $50 million the University paid to the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to What if I used all my gi bill by Don27

The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. That could include people who used military benefits. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to What debt to the school? The by Aw03

The settlement between the FTC and the University of Phoenix does not affect students' private loans or federal government loans. The University is not repaying student loans. The University is not giving refunds.

Under the settlement, the University will cancel $141 million in debts that are owed directly to the school by people who first enrolled between October 1, 2012 and December 31, 2016. The University will cancel debts owed directly to the school whether they were charged as fees or some other kind of charge. The University will send a notice to each person whose debt to the school is being cancelled.

In reply to Does this apply to students by Greg

Under the settlement, the University will cancel $141 million in debts that are owed directly to the school by people who first enrolled at the school between October 1, 2012 and December 31, 2016.

In reply to So, those that attended UoP by RAH_UOP_RCPITN

You can contact the Consumer Financial Protection Bureau about deceptive loans.

In reply to What about those students by ktap

In reply to What about those students by ktap

People who went to the University of Phoenix outside the October 1, 2012 - December 31, 2016 timeframe aren't covered by this settlement. The Federal Student Aid Office of the US Department of Education has information about student loans at www.StudentLoans.gov. It includes information about different ways of repaying, how to consolidate loans, and what to do if your loans have gone into default because you haven't paid.

Pagination