Looking for ways to protect your identity? Two to options to consider are fraud alerts and credit freezes. But what’s the difference?

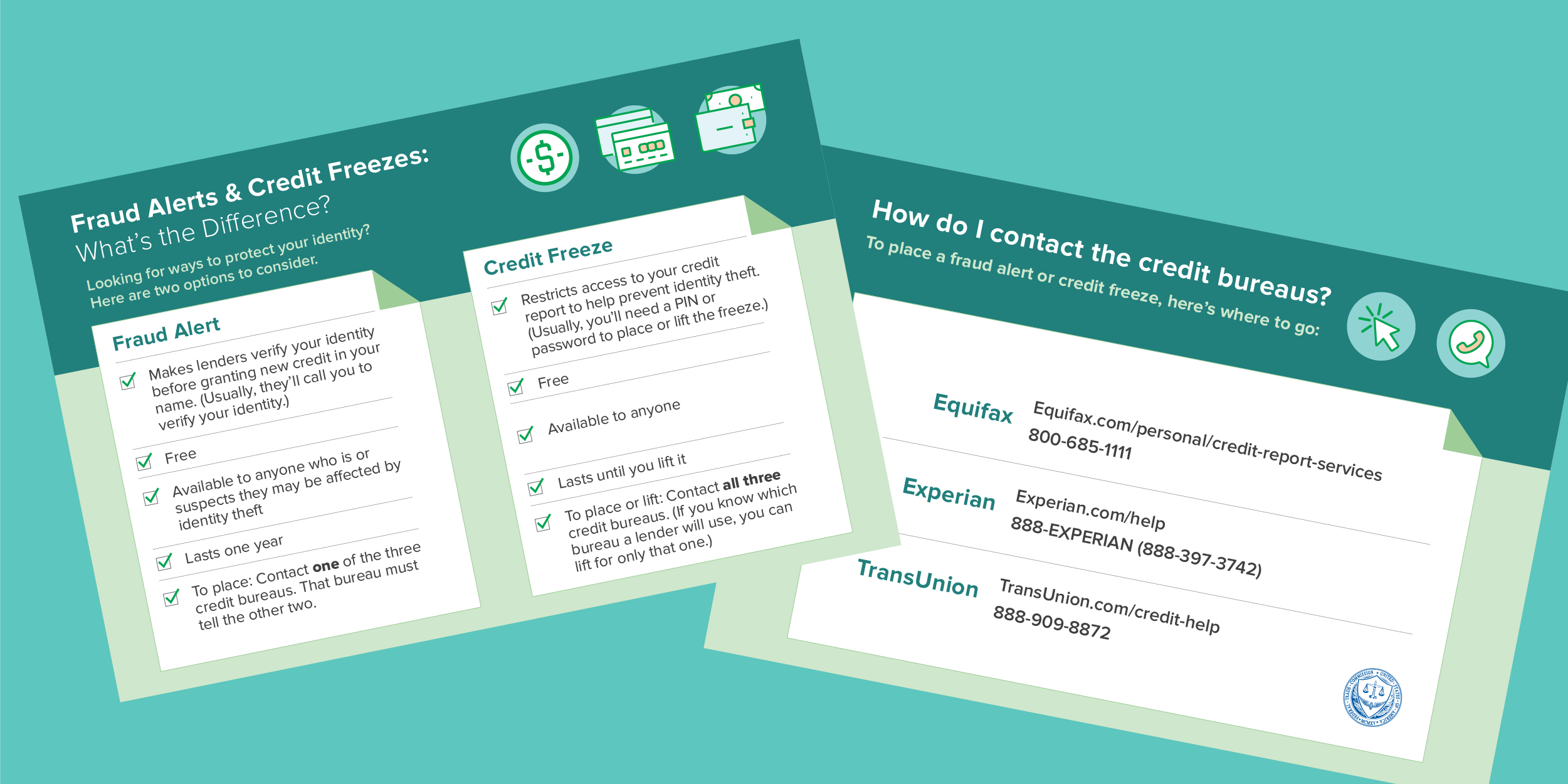

A fraud alert makes companies verify your identity before granting new credit in your name. Usually, that means calling you to check if you’re really trying to open a new account. Placing a fraud alert is easy – you contact any one of the three nationwide credit reporting agencies (Equifax, Experian, TransUnion) and that one must notify the other two. A fraud alert is free and lasts one year.

A credit freeze limits access to your credit report so no one, including you, can open new accounts until the freeze is lifted. To be fully protected, you must place a freeze with each of the three credit reporting agencies. You’ll usually get a PIN or password to use each time you place or lift the freeze. A credit freeze is free and lasts until you lift it.

Which is right for you? It depends on your personal circumstances. Both fraud alerts and credit freezes can make it harder for identity thieves to open new accounts in your name. With a fraud alert, you keep access to your credit. But freezes are generally best for people who aren’t planning to take out new credit. Often, that includes older adults, people under guardianship, and children.

To place a fraud alert or credit freeze, use the credit bureau contact information listed below. Want to share what you’ve learned about fraud alerts and credit freezes? Order these free flyers to hand out in your community.

In reply to I’ve had a credit freeze ever by Lizda

In reply to Lizda, I've kept freezes at by Geezer1

In reply to I froze my credit years ago by natalie

You can use one website to order your free annual credit report from three credit reporting agencies:www.annualcreditreport.com

You may order your reports from each of the three nationwide credit reporting companies at the same time.

Or, you can order your report from each company one at a time. The law allows you to order one free copy of your report from each company every 12 months. There are three companies: Equifax, Experian and TransUnion.

And, starting in 2020, everyone in the U.S. can get six free credit reports a year through 2026 at the Equifax website or by calling 1-866-349-5191. The six credit reports are in addition to the one free Equifax report you can get at www.AnnualCreditReport.com.