People who are homeless or transient may not know they qualify for the $1,200 Economic Impact Payments (EIP) — also called “stimulus checks" — that went out last Spring. They might also get an additional $500 for each qualifying child — and they don’t need an income to claim the payment. That’s why the FTC is working with the IRS to get the word out about how people can still collect their money — and we need your help.

People who are homeless or transient may not know they qualify for the $1,200 Economic Impact Payments (EIP) — also called “stimulus checks" — that went out last Spring. They might also get an additional $500 for each qualifying child — and they don’t need an income to claim the payment. That’s why the FTC is working with the IRS to get the word out about how people can still collect their money — and we need your help.

If you know anyone who doesn’t have a permanent address (or someone who just isn’t aware that they might qualify for a payment), here’s what they need to know:

- The deadline to enter a claim for payment is October 15, 2020. To sign up, people need:

o Their name plus a mailing address and an email address. (People can ask a friend, family member, or shelter to use their address.)

o Date of birth and valid Social Security number (SSN)

o Bank account information, if any

o Identity Protection PIN, if they've gotten one from the IRS

o License or state ID, if any

o Name, SSN, and relationship for each qualifying child

- People who don’t normally file income taxes may still be eligible for a payment. Those with an income below $12,200 ($24,400 for married couples) can get instructions on how to use the IRS’s non-filers tool, then file a claim at IRS.gov/nonfilereip.

- People who get veterans or railroad retirement, Social Security Income (SSI) or Social Security benefits still qualify for this payment.

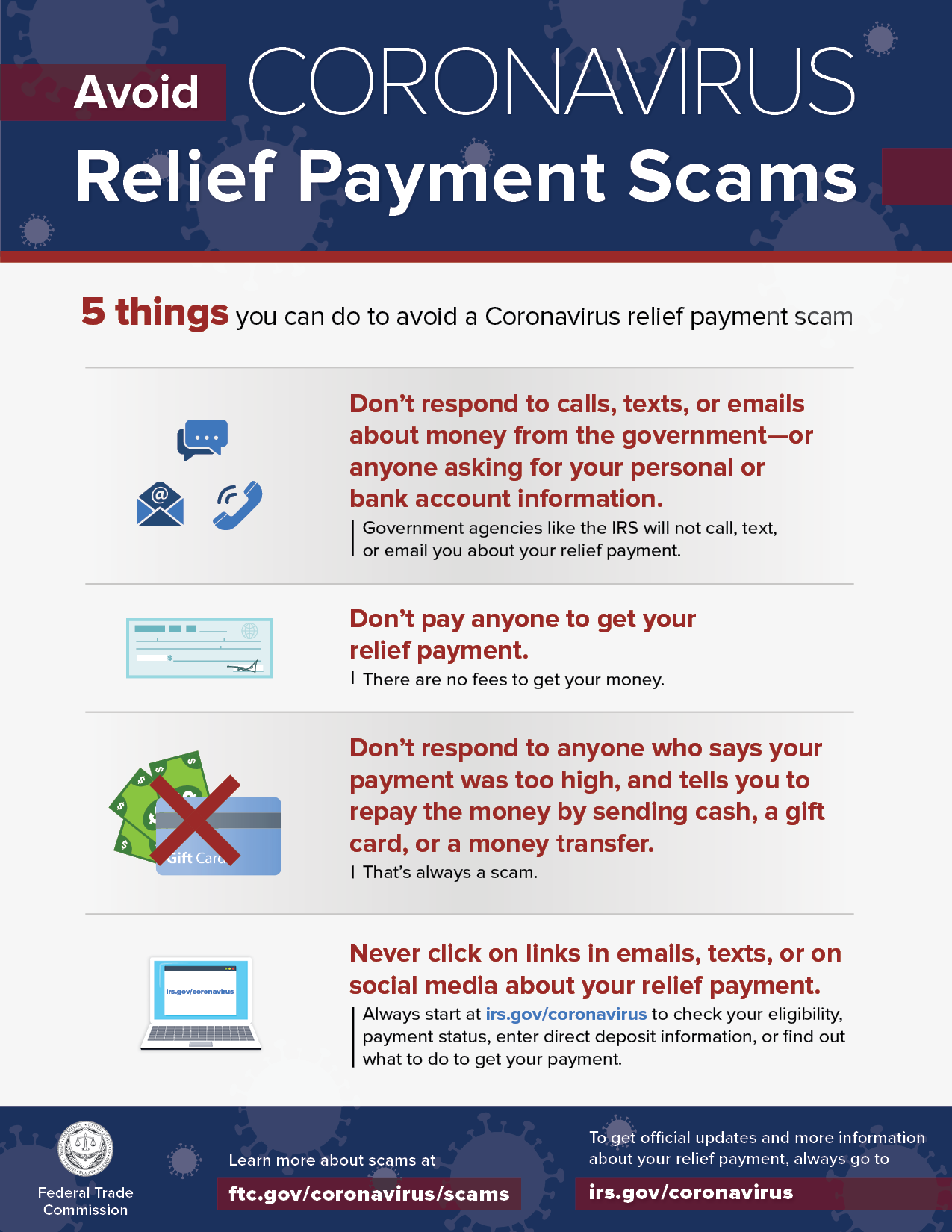

It’s important to know that only the IRS sends out these payments, but they won’t call, text, or email people about their payments. And they won’t charge a fee. So: anybody who calls, texts, or emails offering to expedite an Economic Impact Payment is a scammer. People should never give anyone money to get a payment: anybody who tells you to pay is a scammer.

Visit IRS.gov/coronavirus for more information on economic stimulus payments. The site includes a toolkit for partners to get these messages out to your network. Also visit ftc.gov/coronavirus for information on avoiding Coronavirus payment and product scam and how to report them to the FTC.